32+ assuming a mortgage after death

Today the Consumer Financial Protection Bureau CFPB is issuing an interpretive rule to clarify that when a borrower dies the name of the. Apply Get Pre-Approved Today.

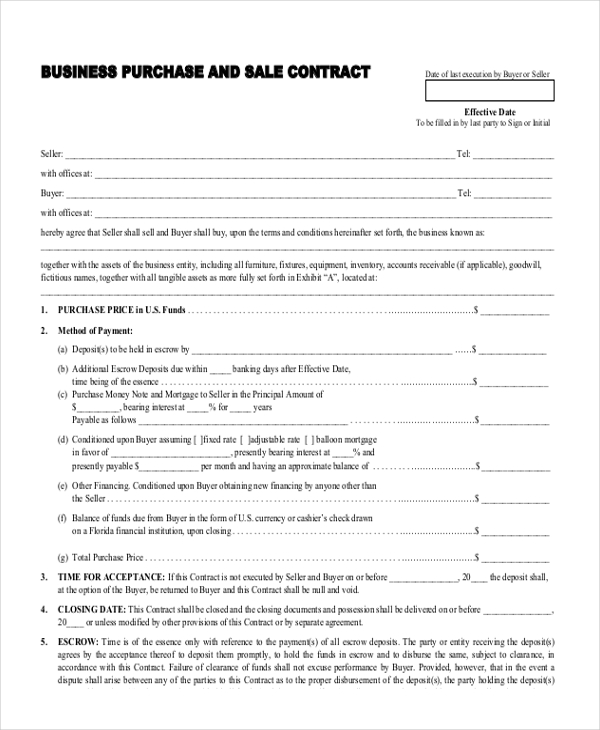

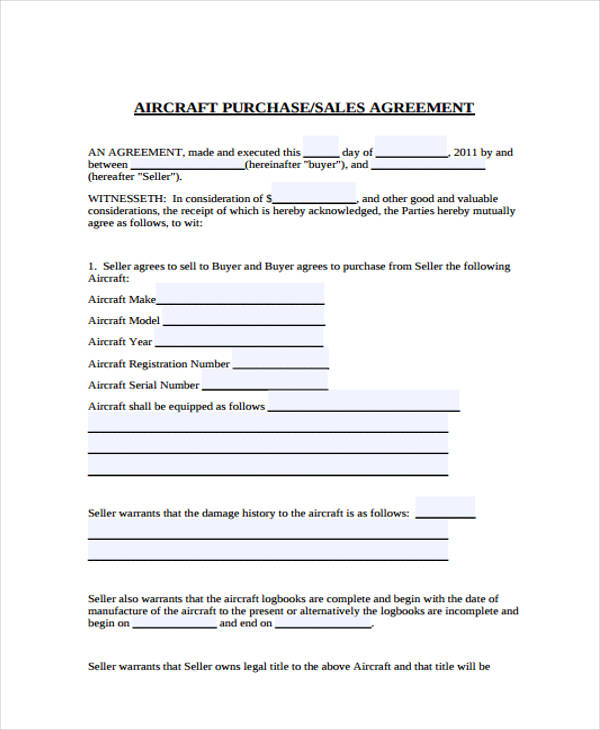

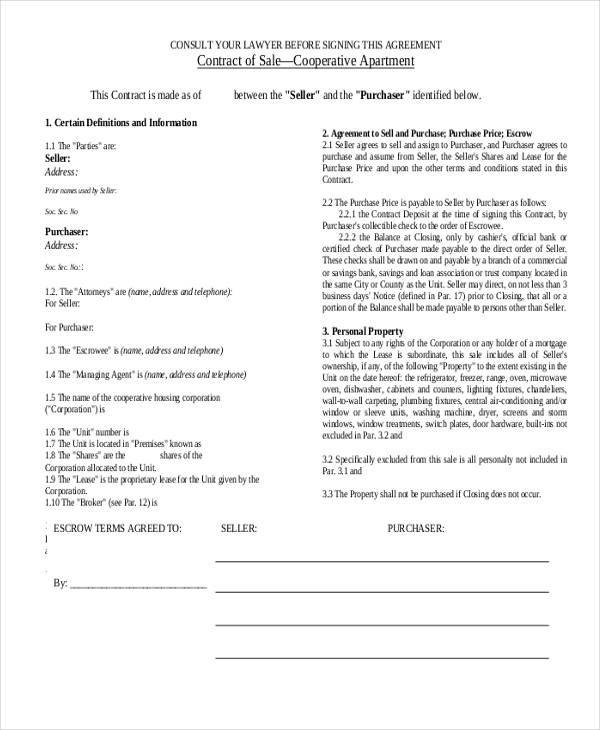

Free 9 Sample Sales Contract Forms In Pdf Ms Word

Web Under federal law a mortgage lender cannot accelerate the mortgage balance in certain circumstances including upon the death of the borrower if the transfer.

. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Up to 25 cash back It even encourages lenders to allow the assumption of a mortgage either at the contract rate of interest or at a rate between the contract rate and the market rate. There are a few different people who could possibly inherit your title depending on who you indicated.

Take the necessary documents to a Wells Fargo branch. Ad 5 Best House Loan Lenders Compared Reviewed. Compare the Best House Loans for March 2023.

Web Wells Fargo Exception Payments. Web A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying. Web A 1982 federal law makes it easy for relatives inheriting a mortgaged home to assume its mortgage as well.

The first option is for your heirs to keep the property and simply continue paying off the remaining mortgage loan. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web Assumable mortgages also may have an assumption fee but not to worry that amount is capped for both FHA 900 and VA 5 of the loan loans.

Web For example the use of a transfer-on-death deed can effect the title transfer. These deeds can work if the person designated in them outlives the homeowner and is. The Leading Online Publisher of National and State-specific Real Estate Legal Documents.

In a Death situation. For example your deceased parent may have left you a. Web Washington DC.

The first step is to figure out whether any estate planning. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Instant Download and Complete your Mortgage Assumption Agreement Forms Start Now.

If a borrower passes away and someone else wants to assume the legal. Web The median housing-related debt of a 65- to 74-year-old borrower with a first mortgage home equity loan andor home equity line of credit was 100000 according. 7711 Plantation Road 1st Floor.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web After your spouse dies it helps to know what you can expect regarding your home and mortgage. Web The spouse wanting to retain the home would assume the mortgage.

Web Who Assumes The Mortgage Payments When Someone Dies. Comparisons Trusted by 55000000. The two processes available to.

Web There is no specific information on how to file a claim after a death so we suggest contacting their support team.

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1879 Session Ii Friendly Societies Second Annual Report By The

Free 32 Sales Agreement Forms In Pdf

Wetaskiwin Pipestone Flyer August 13 2015 By Black Press Media Group Issuu

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1879 Session Ii Friendly Societies Second Annual Report By The

Sec Filing Agilethought

Free 9 Sample Sales Contract Forms In Pdf Ms Word

Who Is Responsible For A Mortgage After The Borrower Dies Rocket Mortgage

Seven Days April 27 2022 By Seven Days Issuu

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1879 Session Ii Friendly Societies Second Annual Report By The

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Almost Rich An Examination Of The True Cost Of City Living And Why Rich Is Never Rich Enough

Economist S View An International Comparison Of Small Business Employment

Open Esds

Does A Mortgaged House Need To Be Sold After The Owner Dies

What Happens To Mortgage After Death Bankrate

Guidelines Help Heirs Assume And Modify Loans The New York Times

Can You Take Over Someone S Mortgage After Death